Arguably the most established commercial application of big data is the way retailers have been tracking and building their consumer database. Whether through building consumer profiles, analyzing purchase records, or even tracking in-store movements, data can reveal unexpected insights:

- With systems in place to analyze unstructured data, retailers can now experience an uplift of 18 to 22% by doing simple behavioral profiling based on clickstreams.

This statistic, reported on retailcustomerexperience.com by Tushar Montaño and Monica Pal, highlights a big reason why retailers are jumping on the big data train.

Scouring through the consumer data for competitive advantage has become somewhat a standard practice among big retailers. Retailers like Zappos and Amazon are now also using personal data to develop customer relationships that could lead to brand loyalty. And if a simple, clickstream-based behavioral profiling could bring an increase of around 20% in purchases, imagine what the newer technology, such as measuring window conversion rates to measure storefront displays and connecting outdoor ad exposure to store visit through the WiFi-based platform, could lead to.

- In 2010, just 1.7% of small businesses were using business software; by last year, 9.2% had adopted such tools.

Reported in New York Times by Ray Boggs, the small-business market analyst at IDC cited easier-to-use products and lower prices as prime drivers of the growth.

The sharp increase of small business embracing intelligence databases nicely dovetails with the trend within big retail chains to track customer purchases with memberships and teaming up with credit card companies. While small business might not always have the recourses to handle the same amount of data those bigger retailers have, nevertheless they could leverage the limited but crucial data they could manage into building a rewarding, intimate relationship with their customers.

The followings are some of the key findings from Inmar 2014 Coupon Trends Report:

- Manufacturer digital offers in market are up 250%

- The number of digitally connected loyalty shoppers is up 40%

- Growth in digital coupon redemptions is up 141%, with over 66mm redeemed

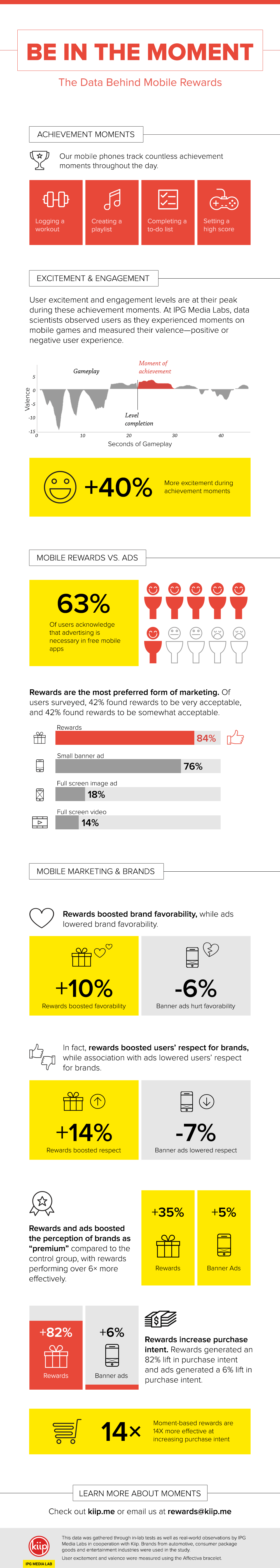

While retailers have gotten fairly accustomed to managing the information they put out on traditional media sources, most of they are still trying to make sense of the new digital and mobile media. It is important to note that these fast growing new media offers the retailers far better channels for data acquisition, whose potential has yet to be fully explored. But with mobile-influenced offline retail sales expected to reach $700 billion by 2016, according to Deloitte, figuring out how to fully engage the online and mobile customers becomes increasingly crucial.